20+ Streamline refinance

How a mortgage pre-approval can help you. The streamline refinance option is exclusive to homeowners with government-backed loans from the FHA VA or USDA.

Elizabeth Porter River City Mortgage

Youll need at least 20 percent equity in your home and a credit score of at least.

. Additional resources to help you refinance student loans. Homeowners often refinance their mortgage to take advantage of falling interest rates rising home prices to avail yourself of the equity in your home or changes in their personal finances. Having 20 equity in your home before you refinance your mortgage is ideal although you can qualify with less equity.

Paying off an adjustable-rate mortgage ARM. You Dont Need A 20 Downpayment To Buy A Home February 20 2019 First Time Home Buyer. 15 year refinance rates.

FHA Streamline Refinance. 20-year term APR 1. 20 year refinance rates.

Mortgage insurance is required on most loans when borrowers put down less than 20 percent. August 29 2022Current Refinance Rates Inch Up. Were mortgage experts who know how to shop various lenders to find you the best loan and rate for your situation.

Refinancing Medical School Loans. As mentioned before this can be anywhere between 05 and 1 of the loan amount before prepaid interest points and is used to cover such things as the processing. Select a type of mortgage refinance.

Our loan comparison can help you decide. Historical mortgage rates chart. The Early-2017 Guide to Buying a Home March 10 2017 Dont Have 20 To Put Down.

Most common refinances are rate-and-term but you can also choose from cash-in cash-out or streamline refinancing to suit your needs. All loan types are eligible. With a conventional mortgage refinance you need at least 20 equity in your home or you will need to pay for private mortgage insurance.

FHA refinance rates and loans are available to those who put down less than 20 percent for their down payment. Here Are Todays Refinance Rates. Streamline refinances are only available for VA FHA and USDA loans.

Rates Requirements for 2022 April 14 2022 The Best Mortgage Refinance Companies for 2022 June 9 2022 Down payment assistance programs in every state for 2022 July 28. Borrowers can put down as little as 35 percent. We streamline the questions you need to answer and automate the document upload process.

Stock drop has erased 3 trillion in retirement savings. The FHA offers a refinance program called the FHA Streamline Refinance which specifically ignores. Current Student Loan Refinancing Rates.

The FHA Streamline Refinance. You Dont Need A 20 Downpayment To Buy A Home February 20. Chart represents weekly averages for a 30-year fixed-rate mortgage.

Average for 2022 as of August 26 2022. The FHA Streamline Refinance is a quick and easy way to lower your FHA mortgage rate and monthly payment. In addition to your down payment closing costs may include the following although they can vary depending on whether the transaction is a purchase or refinance.

Some borrowers are even able to skip the appraisal. These rates may be available when. If you sell the home after only a few years or refinance the mortgage or pay it off buying discount points could be a money-loser.

Having at least 20 equity will help you get the lowest refinance rates. This is the best time to refinance your mortgage. See if todays refinance rates could lower your mortgage payment.

As the name suggests an FHA Streamline is a relatively speedy and simplified process. Compare current refinance rates from multiple lenders. 15-year term APR 1.

15 or 20 years. A streamline refinance is a product for government-backed loans. Learn about the FHA streamline refinance loans guidelines before applying for one.

August 30 2022Current Refinance Rates Climb By Mitch Strohm Editor Todays Refinance Rates. The application process is streamlined for loans under 200000. Graduate degrees and shorter repayment terms terms vary by lender and can range from 5-20 years and include loyalty and Automatic Payment discounts where applicable.

Refinance with no closing costs points or loan fees today. Rates listed above may vary by region and are subject to change. Its nine programs include a fixed-rate program a streamlined interest rate reduction refinance loan IRRRL VA cash-out VA fixed jumbo streamline jumbo and cash-out jumbo in terms of either.

Paying your loan off faster by refinancing a 30-year term to a 10- 15- or 20-year term. However if you can afford to refinance that 20-year mortgage into a 15-year mortgage the combination of a lower interest rate and a shorter term will substantially reduce the total amount of. All FHA loans require the borrower to pay two mortgage insurance premiums.

Homeowners who refinance can wind up paying more over time because of fees and closing costs a longer loan term or a higher interest rate that is tied to a no-cost mortgage. You have many refinancing options including refreshing your rate and term rate-and-term refinance applying more cash toward your equity cash-in refinance pulling money out of your home equity cash-out refinance or opting for a streamline refinance to lower your monthly payments. Here is an example of how discount points can reduce costs on a.

Application requires more paperwork. An FHA streamline refinance is. The advantage of streamline refinancing is that there are minimal credit requirements and the loan processing is typically fast.

The FHA Streamline Refinance is a mortgage refinance product through the Federal Housing Administration FHA that can help homeowners with an FHA loan to lower their interest rate and reduce their monthly payment.

Mlo Ae Jobs Sales Retention Recruiting Tools Processing Changes Fannie And Freddie Appraisal Tweak

How To Get A Mortgage Working In The Cannabis Industry

448 Fha Photos Free Royalty Free Stock Photos From Dreamstime

Memphis Tennessee Home Loan Lenders 901 255 2560 Homerate Mortgage

20 New Years Free Printables Budget Planner Template Budget Printables Monthly Budget Printable

20 Mortgage Statistics And Trends To Be Aware Of Fortunly

How And Why To Refinance Your Mortgage A Step By Step Guide

Financing St Louis Real Estate News

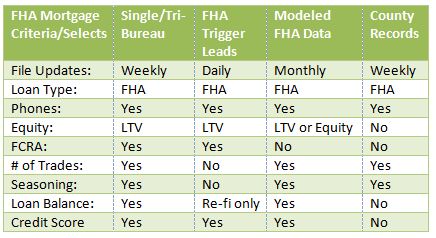

Fha Mortgage Leads

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

20 Mortgage Statistics And Trends To Be Aware Of Fortunly

Northpointe Bank Mortgage Review September 2022 Finder Com

Fha Mortgage Loans Mortgage Network Solutions Llc

How To Use Mortgage Insurance To Buy A Home Find My Way Home

Knoxville Tennessee Home Loan Lenders 865 805 9100 Homerate Mortgage

How Does A Fha Streamline Refinance Work Find My Way Home

How To Get A Mortgage In 8 Steps