House depreciation calculator

A new house purchased for 730000. Estimate depreciation deductions for residential investment properties and commercial buildings.

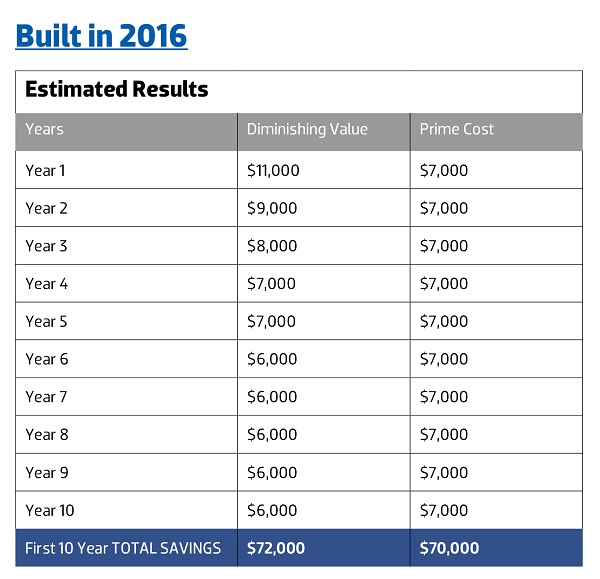

A Guide To Property Depreciation And How Much You Can Save

This rule states that the depreciation recapture on real estate property is not taxed as ordinary income as long as a straight line depreciation was used over the life of the property.

. Anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. I inherited a rental property that was being depreciated. Our tool is renowned for its accuracy and provides usable.

After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year. You find a tenant and the lease begins on Sept. Depreciation is a tax deduction available to property investors.

After working on the house for several months you have it ready to rent on July 15 so you begin to advertise online and in the local papers. Generate Form-16 use our Tax Calculator software. So part of the gain beyond the original cost basis would be taxed as a capital gain but the part that relates to depreciation is taxed at the 1250 rule rate.

The cash flow calculator needs to know your taxable income so that it can work out the benefits you may receive from depreciation and negative gearing. They were being depreciated with a. After a few years the vehicle is not what it used to be in the beginning.

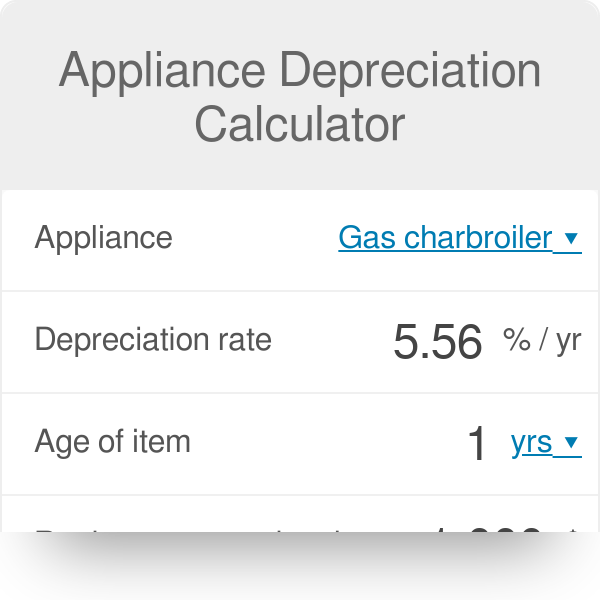

The following article will explain the. If you change your cooperative apartment to rental use figure your allowable depreciation as explained earlier. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own.

A house rent allowance calculator is an online financial tool that helps in computing the amount that an individual can enjoy as tax benefit each year on hisher house rent allowance as per the Income Tax Act 1961. Depreciation under Income Tax Act is the decline in the real value of a tangible asset because of consumption wear and tear or obsolescence. But what about the other assets.

A new house purchased for 730000. The current federal limit on how much profit you can make on the sale of your principal residence that you have held for at least 2 years before you pay capital gains tax is 500000 for a married. Depreciation recapture is the gain realized by the sale of depreciable capital property that.

It and its new floor coverings and appliances have been depreciated for 2 tax years. A P 1 R100 n. DepPro Depreciation Professionals property report investment property calculator investing in property tax depreciation property depreciation Melbourne.

The home appreciation calculator uses the following basic formula. After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year. The basis for depreciation on the house is the fair market value on the date of the change 147000 because it is less than your adjusted basis 164000.

The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. This online calculator aids in simplifying the otherwise cumbersome task of computing tax benefits. How To Calculate ROI on a Rental Property.

In Form 8829 Part III provides the way to figure your depreciation deduction. In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000. Whether to Flip a House or Use Buy-and-Hold.

It allows you to claim a tax deduction for the wear and tear over time on most old or new investment properties. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Depreciation on home office.

Use HomeGains Capital Gains Calculator to determine if your gain is tax free or how much capital gains tax is owed from the sale of a property. Whether you are thinking about replacing your old appliances like a washing machine or dealing with a home insurance policy that offers replacement cash value or actual cash value this calculator has got you covered. If youre not sure how much rent youll receive from your property use 4 of the value for a house or 5 for a unit or townhouse.

A house was bought for 200000 in January 2014. I believe I must start depreciating the property itself for 275 years SL using the net FMV of the building at the date I inherited it as the basis. Where A is the value of the home after n years P is the purchase amount R is the annual percentage rate of appreciation n is the number of years after the purchase.

BMT Tax Depreciation Calculator. You will probably agree that selling it for 20000 again would not be especially fair you have some sort of a gut feeling that it is worth much less now. The house and all other non-removable structures.

Basically it recognises that the building itself plus its internal furnishings and fittings will become worn over time and eventually need to be replaced. You can also get a portion of depreciation related to the house in proportion to the area. Capital works constitute the real investment and should be kept in a well-maintained state of repair for maximum return later at the.

For more click home office depreciation calculator Requirements to Claim the Home Office Deduction.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Schedule Template For Straight Line And Declining Balance

Free Macrs Depreciation Calculator For Excel

Bouquet Hang Medical Rental Depreciation Calculator Vorbamea Ro

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Free Construction Cost Calculator Duo Tax Quantity Surveyors

15 Most Important Real Estate Metrics For Investors

Depreciation Schedule Formula And Calculator Excel Template

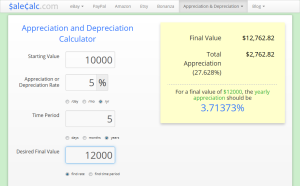

Appreciation Depreciation Calculator Salecalc Com

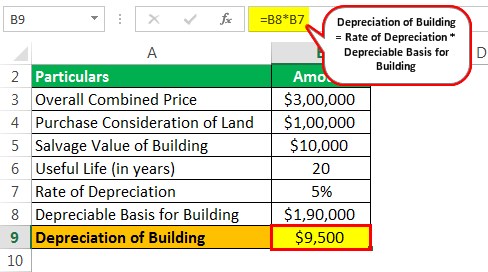

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Appliance Depreciation Calculator

Depreciation Of Building Definition Examples How To Calculate

Rental Property Depreciation Rules Schedule Recapture

How Depreciation Claiming Boosts Property Cash Flow

5 Complex Depreciation Rules Explained Yip